“Backdoor friends are best”

a cross stitched saying that was framed up at one of my childhood friends’ home Tweet

How to contribute to a ROTH IRA even when your income is too high.

There are ways to get money into a ROTH IRA, but I’ve also seen people make mistakes.

What is a Backdoor Roth IRA?

The “Backdoor Roth IRA” isn’t a type of account, but a clever strategy for high-income earners. The process is relatively simple:

- Contribute to a Traditional IRA: You start by making a non-deductible (after-tax) contribution to a Traditional IRA. This means you don’t get a tax deduction for this contribution.

- Convert to a Roth IRA: Soon after, you convert that money from your Traditional IRA to a Roth IRA.

- Pay (or don’t pay) the taxes: Since you already paid taxes on the initial contribution, you generally won’t owe taxes on the converted amount itself.

- Any earnings that may have accrued between the contribution and conversion are taxable.

This maneuver allows you to bypass the income limits for direct Roth IRA contributions and get your money into a Roth, where it can grow tax-free for the rest of your life.

The mistake I’ve seen people make is not considering the ‘Pro-Rata Rule’.

The pro-rata rule applies when you have a mix of pre-tax and after-tax money across all of your Traditional, SEP, and SIMPLE IRAs combined. The IRS views all these accounts as one big pool of money.

Here is an example:

Imagine you have a Traditional IRA with $95,000 in pre-tax funds (from old 401(k) rollovers or deductible contributions) and you want to do a backdoor Roth with a new, after-tax contribution of $7,000.

The total value of your Traditional IRA accounts is now $102,000. Of that, only $7,000 is after-tax money.

Now, you convert that $7,000 to a Roth IRA. The IRS doesn’t let you just convert the after-tax portion. The pro-rata rule requires you to convert a proportional mix of both pre-tax and after-tax funds.

Here’s the math:

$7,000/$102,000 is approximately 6.86%

This means only about 6.86% of your conversion is tax-free. The other 93.14% is considered pre-tax and is therefore taxable.

So, even though you only converted $7,000, you would owe income tax on approximately $6,520 of it. This can lead to an unexpected tax bill and defeats the purpose of the backdoor Roth IRA.

How to Avoid the Pro-Rata Rule Trap

The key to a successful backdoor Roth is to have a zero balance in your pre-tax Traditional, SEP, and SIMPLE IRAs. If your Traditional IRA only contains non-deductible contributions (the ones you just made for the conversion), the pro-rata rule doesn’t apply, and your conversion is tax-free.

However, MANY PEOPLE don’t properly track how much they have in after tax money and they pay tax on this portion twice! You can file form 8606 to keep track of it.

A possible fix to open up a Backdoor Roth IRA strategy:

If you have pre-tax money in your IRAs, you can:

- Roll over your pre-tax IRA funds into a workplace retirement plan like a 401(k) or 403(b), if your plan allows it. Employer plans are not considered in the pro-rata calculation for IRAs, so this effectively “cleans out” your IRA.

- Convert the entire IRA balance to a Roth IRA. This will trigger a tax bill on the pre-tax portion, but it gets the money into a Roth account for future tax-free growth. This might be a good option if your pre-tax balance is small.

Of course, work with your CPA and a financial advisor that knows what they are doing (wink wink), before you execute any of these strategies.

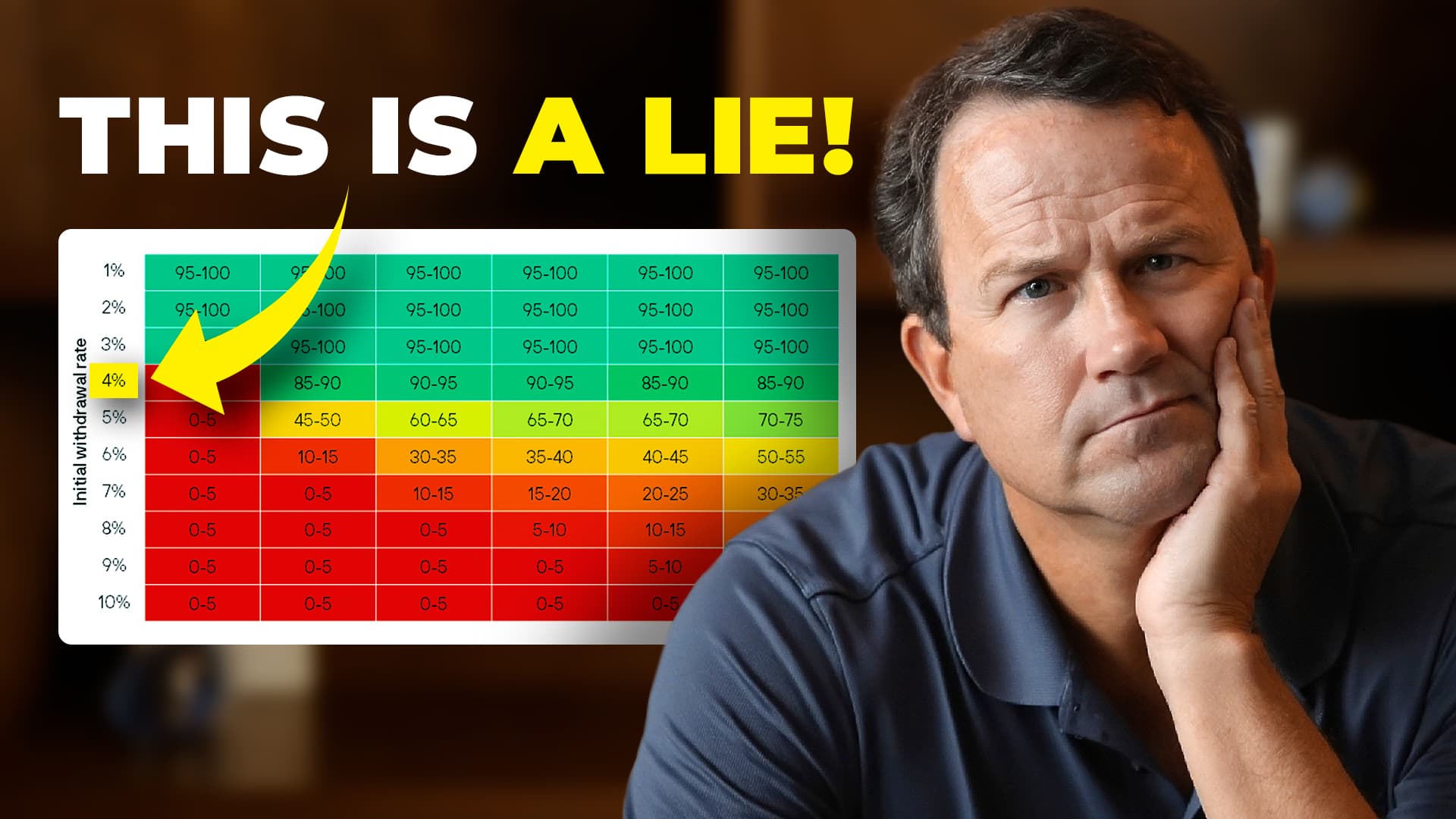

Check out our new video, ‘5 Lies Retirees Believe, but Proven False’.