“Patience is bitter, but its fruit is sweet.”

– Aristotle Tweet

Each year, retirees who are age 73 (or 75, depending on birth year) must take their Required Minimum Distributions (RMDs) from their pretax retirement accounts. Many people check the box quickly in January, just to get it done. But sometimes, doing it early could actually cost you.

Here’s why:

- Early RMDs Close the Door on QCDs

A Qualified Charitable Distribution (QCD) lets you give directly to charity from your IRA once you’re 70½. That gift reduces your taxable income dollar for dollar. But if you’ve already satisfied your RMD in January, the chance to apply a QCD toward that year’s required withdrawal is gone. The IRS won’t let you retroactively count it. - Income Planning Is a Moving Target

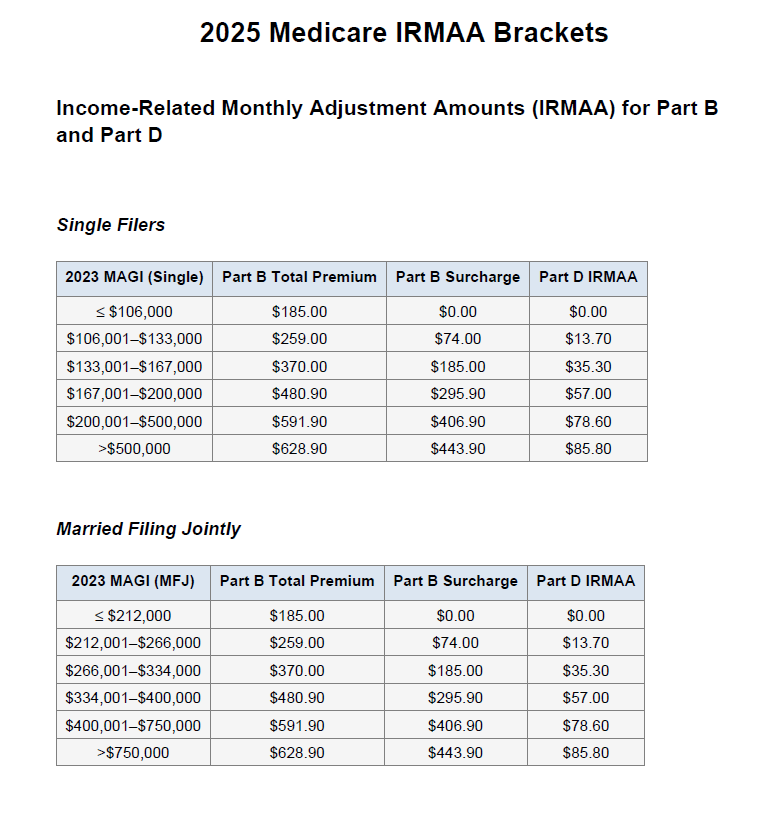

Life changes, tax laws change, and your income picture shifts through the year. Maybe you sell stock, downsize your home, or earn unexpected dividends. If you’ve already pulled out your full RMD, you’ve got less flexibility to offset that new income with QCDs. - IRMAA Surcharges Can Sting

Medicare’s Income-Related Monthly Adjustment Amount (IRMAA) is a stealth tax for high-income retirees. Go just one dollar over the income thresholds, and your premiums can jump by thousands a year. A well-timed QCD can help keep you under those thresholds—if you haven’t locked yourself out by taking your RMD too early. - Mid-Year Checkups Help

Instead of rushing, consider waiting until later in the year—after you have a clearer picture of income, charitable goals, and potential tax surprises. This gives you time to align your RMD strategy with your tax plan. - Flexibility Beats Finality

Think of it like golf: you wouldn’t tee off without first checking the wind. In retirement, rushing your RMD is like hitting the ball blind. By pacing yourself, you keep options open, improve tax efficiency, and may save thousands over time.

Lesson: RMDs are mandatory, but when you take them matters. Don’t let haste in January cost you options in December.