When I think of estate planning 101, the word that comes to mind is legacy. A legacy isn’t just an inheritance; it’s also the lasting impact and values that we leave behind. Estate planning is one of the ways to preserve that legacy.

What is Estate Planning?

Estate planning involves preparing for the management and distribution of assets in the event of incapacity or death. It involves creating a plan that outlines healthcare preferences, end-of-life plans, and how assets should be handled. It serves as a method of providing instructions, offering clarity for heirs, and direction for loved ones.

Ideally, this all eases the burden for your loved ones during this difficult time.

Think of estate planning as a journey with two distinct phases, each equally vital in shaping your financial future and legacy.

Phase 1: Organizing Your Financial Landscape

This phase is about getting a clear picture of your financial situation and your goals. This is where you will decide what really matters most to you, and where you will calibrate what goals are practical and realistic to accomplish.

Phase 2: Legal Safeguards for Your Wishes

Once your financial plan is set, the next step is to secure it legally. An estate attorney will craft the legal documents needed to align your assets to your wishes in a customized fashion. This legal framework is key to protecting everything you’ve built. And it actually goes far beyond just financial decisions.

When Should I Start Estate Planning?

Some would argue that your first estate plan should be completed on your 18th birthday. For others, it isn’t on their radar until age 70. The answer for each person is not an exact age but often a significant life event that makes them consider estate planning.

More on that later.

Key Components of an Estate Plan

1. Last Will and Testament

This legal document outlines your final wishes for distributing your assets and caring for minor children, if applicable. Without a will, these matters are left to the courts to decide, which may cause delays, stress, and conflict among loved ones.

2. Trusts

Trusts are legal entities that can provide an additional level of control over your assets during your lifetime and after your passing. They can be used to provide for a loved one with special needs such as addiction issues, mental health struggles, lack of impulse control, or lack of financial discipline. They can also help avoid probate, which is the legal process of distributing assets that can sometimes take months or even a year to complete.

3. Powers of Attorney

What if a medical emergency leaves you unable to manage your finances or make healthcare decisions? A power of attorney (or POA) allows you to designate an individual to make these decisions on your behalf when you are unable to express them yourself. You can also grant someone power of attorney for specific tasks, such as managing business affairs.

4. Advance Healthcare Directives

What if you feel strongly about specific healthcare decisions, and don’t want to put those decisions in anyone else’s hands? If you know how you want these decisions to be handled, then a healthcare directive is paramount. This document specifies the type of medical care you wish to receive if you’re incapacitated and no longer able to make or communicate those decisions.

This isn’t just for the elderly. Some people get in a car accident, wind up in a coma, and without an advanced healthcare directive, the medical decisions can be ambiguous.

Estate Planning: 5 Steps to Chart Your Course

1. Take Inventory of Your Assets and Debts

Start by listing everything you own and owe. This includes tangible assets like your home, vehicles, and other personal belongings, as well as intangible assets like bank accounts, investments, retirement accounts, insurance policies, and debts.

Write down details of each: Descriptions, locations, years acquired, current estimated value, legal descriptions, or other identifying features depending on the asset/item/property.

2. Articulate Your Goals

Consider what you want your legacy to reflect. Defining your goals is a foundational step in giving your wishes a tangible form. Clarity on this can be foundational to help inform the more technical estate planning decisions.

Are you focused on providing for loved ones, leaving a charitable legacy, addressing potential estate taxes, or a combination of these? The details and specifics matter.

3. Choose Your Beneficiaries

Decide who will inherit your assets and how they will be distributed. Be specific in outlining your wishes to avoid misunderstandings. Beneficiaries can include your spouse, children, other family members, friends, or charitable organizations.

4. Enlist Expert Guidance

Seek advice from professionals such as estate planning attorneys, financial advisors, and tax professionals. These experts can help you understand your options, craft a plan tailored to your situation, and take some of the burden off you. They also can help to identify potential pitfalls to avoid and keep you compliant with legal requirements.

5. Review and Update Regularly

Life events or changes in your financial situation may warrant a review of your estate plan. Events like marriage, divorce, a birth in the family, a death in the family, a significant inheritance, or relocation may require updates to your plan. Regular reviews and updates can address these changes and keep your plan relevant to your life as it evolves.

The Role of Trusts in Estate Planning

Trusts are versatile tools that holds assets for the benefit of someone, during or beyond their lifetime. They can offer flexibility and/or control and can be structured to address specific needs.

Here are a few different types of trusts:

Revocable Living Trusts

A revocable living trust allows you to maintain control over your assets during your lifetime while providing flexibility to make changes as needed. This type of trust is particularly useful for individuals who want to manage their estate actively while they are still alive.

Irrevocable Trusts

Irrevocable trusts are more rigid but offer potential tax benefits by removing assets from your taxable estate. This can provide the advantage of removing assets from your name directly, which can reduce estate taxes and potentially provide other benefits as well.

The key word is irrevocable though. It can be extremely difficult if not impossible to reverse the decision once assets are inside this form of a trust.

We recommend that you consult with a tax attorney to determine if this type of trust may make sense in your situation.

Special Needs Trusts

This trust serves to protect the financial well-being of individuals with specific needs. Special needs trusts can help a loved one with disabilities by providing financial support without necessarily jeopardizing their eligibility for government benefits.

How Trusts Can be Used to Manage Assets

A trust can be used to attach strings to assets by leaving instructions for how to manage and distribute assets, such as when to distribute them and how to invest them. For example, you can use a trust to:

- Delay the distribution of assets until certain conditions are met, such as when the beneficiary reaches a certain age.

- Use a trustee to control the distribution of funds to a beneficiary based on their behavior. For example, you could use an “incentive trust” to reward good behavior, such as going to college, or discourage destructive behavior, such as using drugs or alcohol.

- You can use a trust to place restrictions on how certain property can be used. For instance, you can put certain land under restrictions of how it may be developed well beyond your own life.

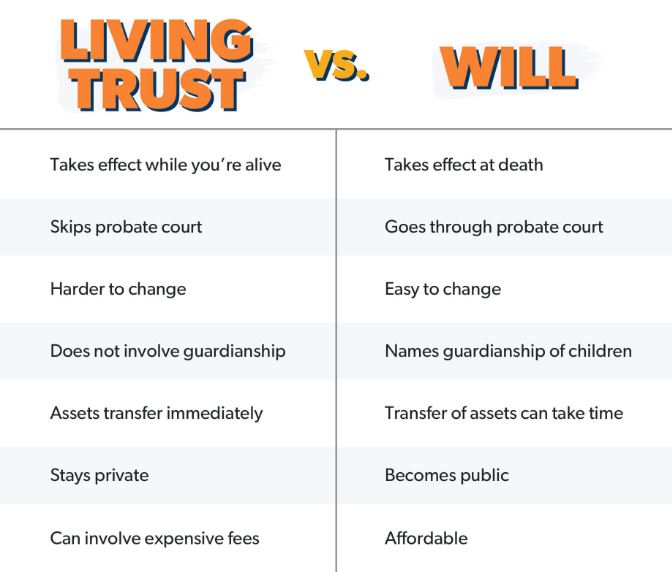

What’s the Difference Between a Will and a Trust?

Wills

A will only takes effect after death and outlines how your assets are to be distributed, who will be the guardian of your children, and who you appoint to handle your final affairs. Without a will, the courts make these decisions.

A will is effective only after death and serves as a roadmap for asset distribution, guardianship of children, and appointment of an executor.

Trusts

Unlike a Will, Trusts can be established and implemented during your lifetime and offer more control over asset distribution. They are particularly useful for managing assets if you become incapacitated and can provide tax benefits, control, and privacy that wills do not.

Pros and Cons of Each – A Side-by-Side Comparison

Scenarios where one might be more suitable than the other

- Wills can be sufficient if your estate is relatively simple, your main concern is ensuring your assets are distributed according to your wishes, and you don’t mind putting your beneficiaries through the probate process.

- Trusts are better suited for more complex estates, if you want to avoid probate, add a layer of privacy, or want to plan for potential incapacity. Trusts can also be valuable if you have specific conditions for how and when beneficiaries receive their inheritance, such as in the case of minor children or family members with special needs.

Estate Taxes: What You Need to Know

Overview of estate taxes and their impact on estate planning

Estate taxes apply to the transfer of property (assets) to your heirs upon your passing. These taxes apply to estates and gifts over a lifetime that exceed $13,990,000 (as of 2025). That ~$14M figure can change though, and there are political debates that will occur throughout our lives that can shift the number in either direction. If it shifts lower, it will likely impact many more people.

If for instance, it settles in the $3M range at some point: Even if you have less than that now, it may exceed that number in your lifetime. In that instance, you would want to start planning ahead rather than just letting your assets grow past the limit.

Common strategies to manage and potentially minimize estate taxes

- Gifts – In 2025, you can gift $19,000 per recipient per year which is kept separate from the lifetime gift & estate tax exemption. So if you have more than enough money to get through your own life, then consistent gifting to multiple recipients can be a viable strategy to transfer wealth gradually and possibly minimize the estate’s tax liability.

- Charitable donations – There is no limit to the amount that you can donate to charity. There are ways to give to charity during AND after your life though that may keep more in your hands and the charities hands, and less in Uncle Sam’s hands.

- Trusts – As mentioned earlier, a trust is a way to keep assets out of any one individual’s name. Irrevocable trusts are no longer considered a part of your estate, and thus exempt from the estate tax.

Updating Your Estate Plan

If any of these events occur, it may be time to consider updating your estate plan:

- A birth in the family

- A death in the family

- A major health event in the family

- When a family member has a special need

- A marriage in the family

- A divorce in the family

- An out-of-state or out-of-country move

- The receipt of an inheritance

The Importance of Regularly Reviewing and Updating Your Estate Plan

Estate planning is not a one-time event. Life has a way of throwing curve balls. An out-of-date estate plan can lead to unintended consequences, so periodic reviews especially after major life events are recommended.

Like any financial tool in our belt, Estate Planning should be adaptable to reflect your wishes, needs, and goals as they evolve. Regular reviews of your Estate Plan might save your loved ones time, energy, stress, and money down the line.

Financial Planning vs. Estate Planning

While a full estate plan is written up by an attorney, a holistic fiduciary financial advisor can also play a role in the preparation process prior to writing up documents. They can act as a guide on the following matters:

- Stay in communication with you about your life changes and potential financial considerations that stem from those changes

- Be a resource of information on financial decision points

- Potentially identify the need for updates to your estate plan

- Maintain an awareness of potential tax implications for various decisions

- Keep your heirs’ needs and other future goals factored into your plans

- Maintain an accurate inventory of your assets, financial products/contracts, pensions, benefits, current account titling, identify new account titling opportunities, identify new account opening and funding opportunities, and make sure your beneficiary designations align with your wishes

- Help you determine which assets make the most sense to gift during your lifetime, which ones to use for your own spending, and which ones to choose to pass on

- Keep track of all of the potential moving parts

- Be your main source of accountability in keeping your finances aligned with your long-term needs and goals

Seek the Help of Knowledgeable Guides

Benefits of consulting with estate planning professionals

Estate planning is complex, and seeking the guidance of experienced professionals can make your life easier. These professionals are your allies. They can guide you through this process, providing valuable support every step of the way.

- Financial advisors –Can be your main point of contact on all financial considerations, and help you align all financial decisions with your values, goals, and needs.

- Tax Professionals – Can identify and help you implement tax strategies before during and after the estate planning process.

- Estate Attorneys – Will actually write up the documents and implement your estate plan. Ideally, prior to doing so, they will confirm the details of your goals, needs, and wishes.

How to choose the right professional for your needs

The two main considerations for choosing the right professionals are:

- Their level of competence.

- Your trust in them.

Beyond that though:

- We recommend advisors that work in a holistic, fiduciary capacity.

- We recommend CPAs that engage in long-term tax planning rather than simply filing tax returns.

- We recommend Attorneys that take the time to:

- Understand your situation and your desires

- Explain the details of each core aspect of the documents

- Draft very thorough legal documents

Recap of The Importance of Estate Planning

Estate planning is the framework for creating legal protections that honor your final wishes. This process begins with thoughtful preparation, often before a consultation with an attorney, where you define your goals, assess your overall finances, and consider the lasting impact you’d like to build.

Being proactive rather than reactive in this area is a massive gift to those who matter most to you.

Encouragement to Take the Next Step

Don’t worry about having all the answers or preparing for every eventuality just yet.

Taking the first step toward estate planning is simply an assessment of your current situation and your future goals. Start where you are and take the time to thoughtfully shape your plan. By starting with one step at a time, you can gain clarity without overwhelming yourself with every detail.

Ultimately, estate planning is a pathway to leaving a legacy for your loved ones that can last long after you’re gone.