“No wise pilot, no matter how great his talent and experience, fails to use his checklist.”

Charlie Munger Tweet

I am a HUGE Charlie Munger fan.

One of the many valuable lessons he taught was the difference between first-order and second-order thinking.

A simple explanation is: First-order thinking is short-term, and second-order thinking is long-term.

The first-order actions could be the opposite of the second-order thinking. Ice cream may taste good today, but it may have long-term negative effects.

Understanding the initial outcome is just the beginning. Second order thinking helps us look at the ripple effects of each decision.

The first-order is: I want to reduce my taxes now

And the second-order is: I want to reduce my lifetime taxes.

A great example is Roth Conversions.

When we do a Roth Conversion, we take some portion of our pre-tax IRA account and we move it into the tax-free ROTH IRA.

We pay the taxes on those funds today with the second-order thinking of creating the best long-term outcome.

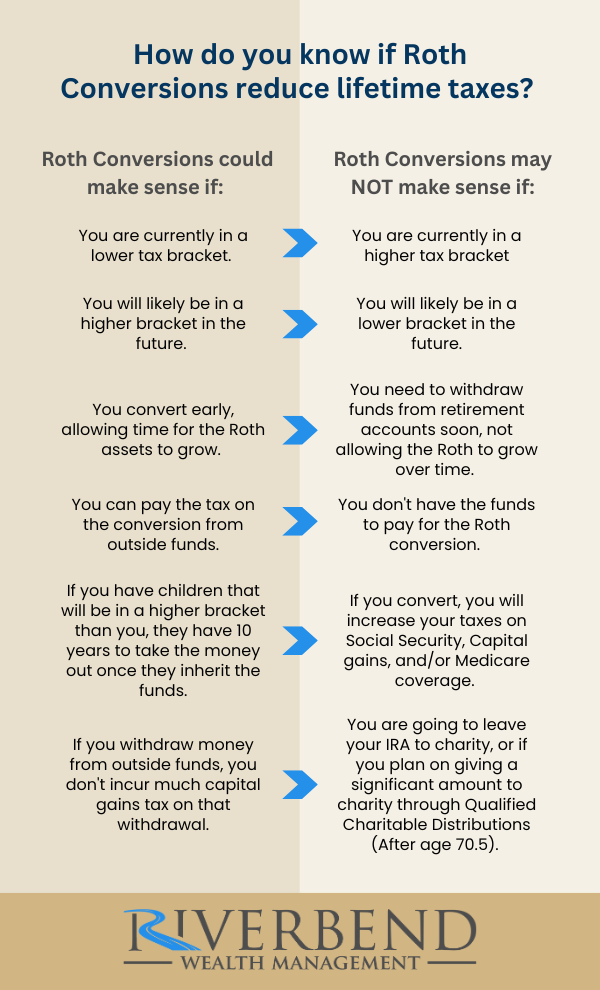

Roth Conversions makes sense IF they reduce your lifetime taxes.

How do you know if Roth Conversions will reduce lifetime taxes?

The timing and the amount of the Roth conversions are crucial.

If you execute it properly, you could reduce your lifetime taxes by $1,000,000 or more.

If you would like to see how you could reduce your lifetime taxes, contact us. You can just reply to this email.

Check out our latest video: 84% of Retirees Make This Mistake (& How To Fix It)